With Sonect, users can easily withdraw cash at the store checkout in over 2300 shops throughout Switzerland via app. The functionality has now been integrated into TWINT and is available to the more than 3 million TWINT users with immediate effect.Although cash is becoming less and less important, according to a recent study, 67% of consumers in Switzerland see cash as essential. The ATM network has been in continuous decline for years, making it increasingly difficult to withdraw cash, especially in rural areas. In other words, precisely where cash plays an even greater role. With the Sonect app, cash can be withdrawn at over 2300 participating stores, for example at all k kiosks or Volg stores.

Simplified cash withdrawal for all TWINT users

As of now, the Sonect functionality is also available in the widely used and popular TWINT app. The Sonect service is thus available to over 3 million TWINT users throughout Switzerland. This means that Sonect has gained another major partner. “We are very pleased to now have another strong partner on our side with TWINT. This will help us grow and further simplify cash withdrawals in Switzerland” says Sandipan Chakraborty. TWINT CEO Markus Kilb is also pleased about the cooperation: “We always pursue the goal of making everyday life as easy as possible for our customers. And if there should be situations in the future where cash is essential, we even offer that in our app with the integration of Sonect.”

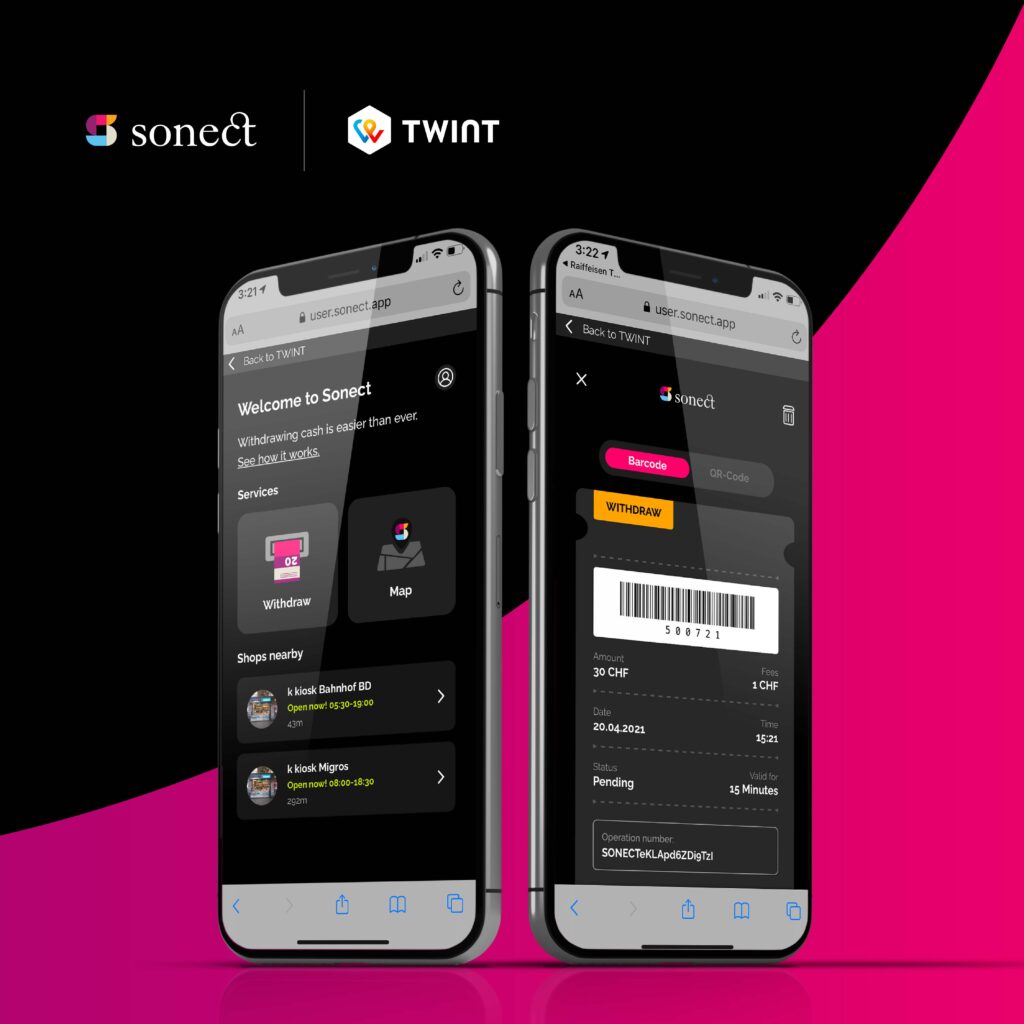

It’s as simple as this: Users enter the desired cash amount in the TWINT app, and a barcode is generated. This is scanned by the cashier either with the Sonect Shop app or with the cash register’s barcode reader, and the amount is issued in cash. Sonect’s proprietary algorithm ensures that the user always finds a store that can dispense the cash at that exact moment and in that exact location.

Already the largest cash withdrawal network in Switzerland

“With 2300 Sonect locations to date, we are already the largest cash withdrawal network in Switzerland, and we will continue to expand this in the coming months” says Sandipan Chakraborty, founder and CEO of Sonect. He adds: “Sonect turns every cash register into an ATM. We are targeting smaller stores in outlying regions as well as large and widespread retailers. We are happy to welcome all TWINT users on our platform”. Sonect also cooperates directly with financial institutions and supports them in providing cash to their customers.

About Sonect

Sonect is a fintech startup headquartered in Zurich. It was founded in 2016 and employs 32 people in Zurich, Vilnius and Mexico City. The startup offers a platform that makes financial services easily accessible from anywhere. Sonect turns every cash register into an ATM and, thanks to the Sonect app, cash can be withdrawn easily, largely independent of infrastructure and therefore cost-effectively. More than 2,300 locations offer cash withdrawals with Sonect, making it the largest cash withdrawal network in Switzerland. Sonect is active in various European countries as well as overseas. The startup was named “Next Global Hot Thing” at the 2019 Swiss Digital Economy Award’s.

www.sonect.net

About TWINT

With TWINT, cashless payments can be made directly from bank accounts in e-commerce, at the checkout and at vending machines. In addition, funds can be sent and requested from private individual to private individual. With TWINT, users also benefit from added value such as the deposit of customer cards. With more than three million registered users, TWINT is the most widespread mobile payment solution in Switzerland. TWINT AG is owned by the largest Swiss banks: BCV (Banque Cantonale Vaudoise), Credit Suisse, PostFinance, Raiffeisen, UBS, Zürcher Kantonalbank as well as SIX and Worldline.

www.twint.ch

Contact and further information

Steivan Pitsch

Head of Marketing

[email protected]